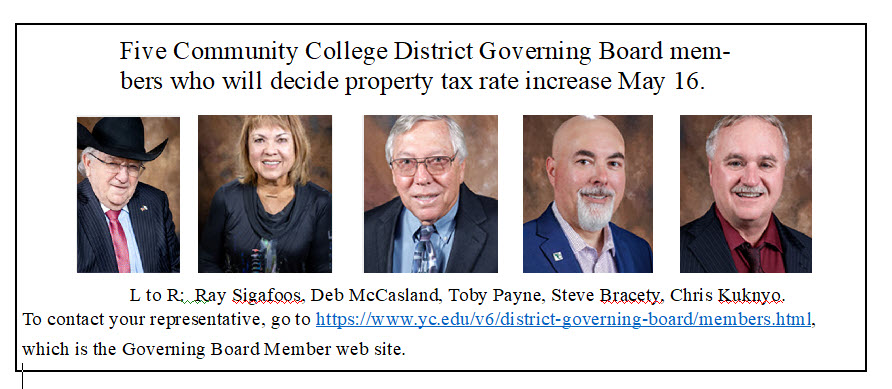

Yavapai Community College considering this tax rate increase, which follows on the heels of last year’s 5% tax rate increase

The Yavapai Community College District Governing Board meeting will be held at the Sedona Campus on Tuesday, March 19. The session will commence promptly at 1:00 p.m. Residents are invited to voice their concerns or opinions to the District Governing Board during the call to the public, typically held at the outset of the meeting.

The Yavapai Community College District Governing Board meeting will be held at the Sedona Campus on Tuesday, March 19. The session will commence promptly at 1:00 p.m. Residents are invited to voice their concerns or opinions to the District Governing Board during the call to the public, typically held at the outset of the meeting.

This meeting presents an important chance for community members to weigh in on the proposed 4% cumulative tax rate increase for next year’s budget. Your input matters, and this forum offers a platform for your voice to be heard.

Please note that in order to accommodate all speakers, the Board typically limits public comments during the open call to three minutes per person.

The first method involves the issuance of General Obligation (GO) bonds, a traditional avenue that necessitates a county-wide campaign to explain the necessity for such funds to Yavapai County voters. This approach mandates a transparent explanation of why substantial investments are directed toward certain areas within the County, potentially at the expense of others.

The first method involves the issuance of General Obligation (GO) bonds, a traditional avenue that necessitates a county-wide campaign to explain the necessity for such funds to Yavapai County voters. This approach mandates a transparent explanation of why substantial investments are directed toward certain areas within the County, potentially at the expense of others. Yavapai Community College Vice President of Finance and Administrative Services announced at the November 26 District Governing Board meeting that the administration will ask for a two percent tax rate increase in 2024. The increase is needed, according to Dr. Ewell, to help provide funds for an estimated $3.36 million in additional revenue. If approved, the tax rate increase will add about one-third of the additional revenue the College says it needs.

Yavapai Community College Vice President of Finance and Administrative Services announced at the November 26 District Governing Board meeting that the administration will ask for a two percent tax rate increase in 2024. The increase is needed, according to Dr. Ewell, to help provide funds for an estimated $3.36 million in additional revenue. If approved, the tax rate increase will add about one-third of the additional revenue the College says it needs.

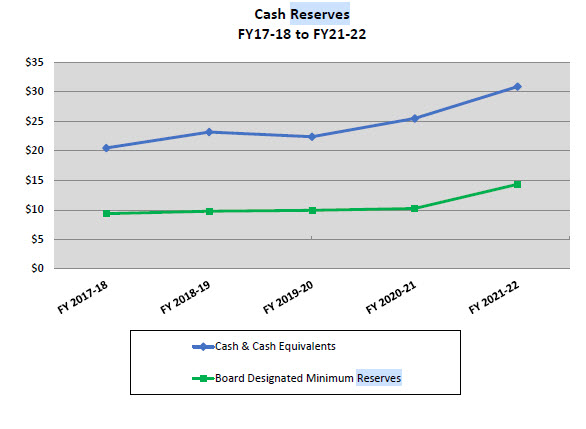

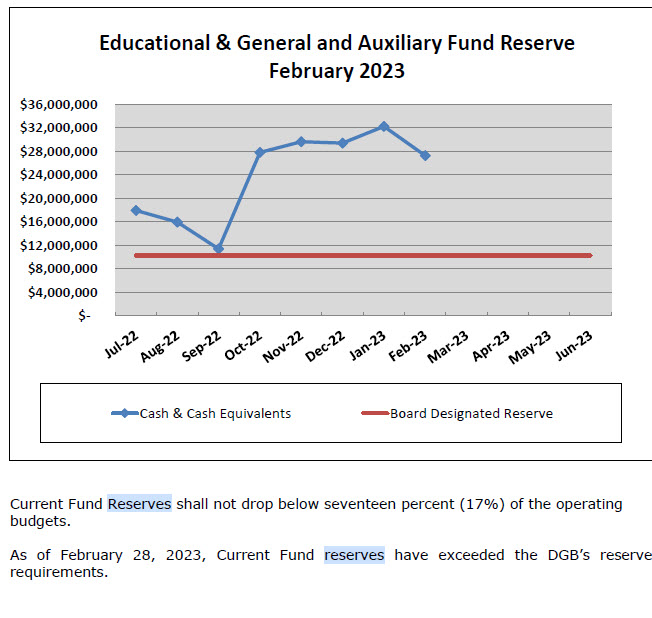

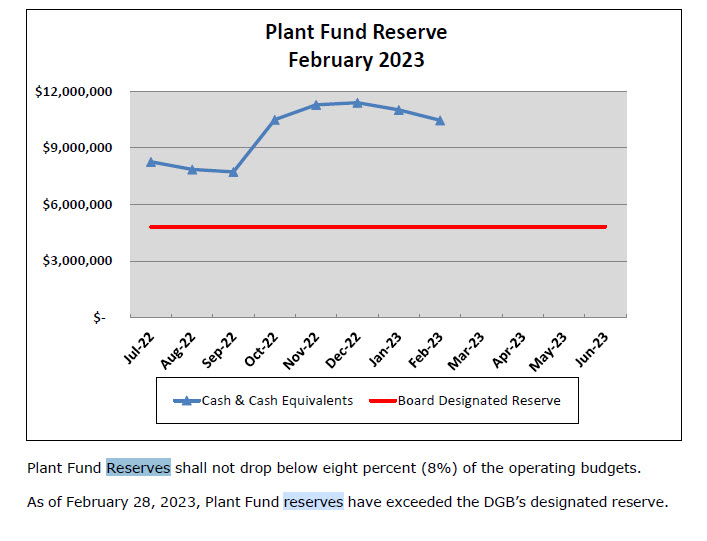

Yavapai Community College reported to the District Governing Board at its April 11 meeting that it now has cash reserves of $32.3 million. These reserves have been accumulated, according to the Community College, through “sound fiscal management.”

Yavapai Community College reported to the District Governing Board at its April 11 meeting that it now has cash reserves of $32.3 million. These reserves have been accumulated, according to the Community College, through “sound fiscal management.”