Governing Board Modifies past budget but provides County property taxpayers no relief

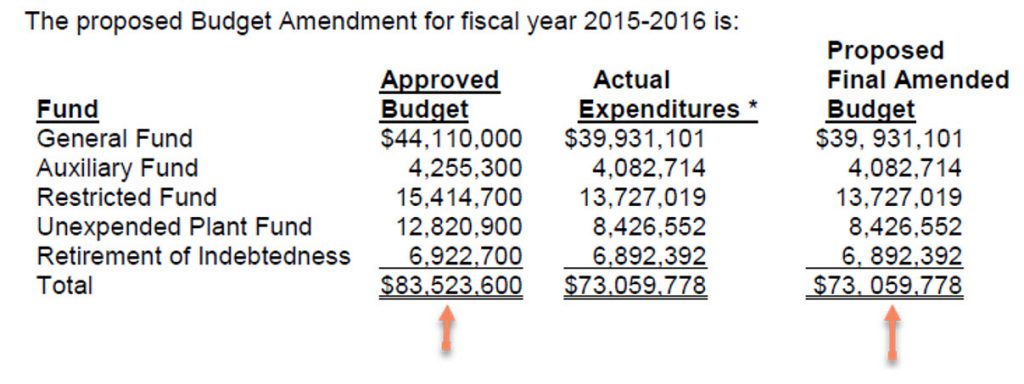

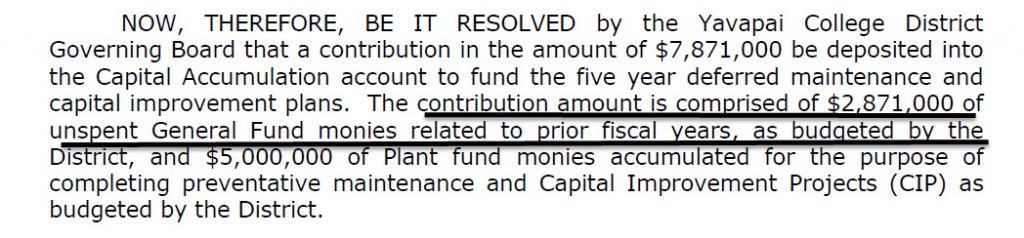

It is hard to believe that the College over budgeted in the fiscal year 2015-16 by ten million dollars. However, that is what it reported to the Governing Board at its January meeting. In the agenda for that meeting, the College reported in writing it did not spend $3.9 million of its 2015-2016 budget. However, that figure exploded without explanation to $10 million during the College’s presentation to the Board.

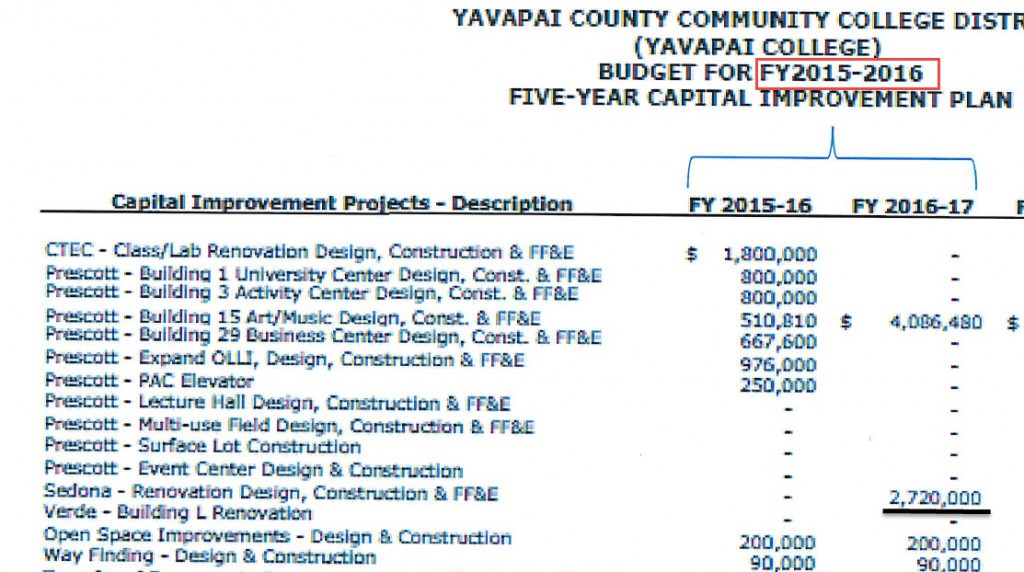

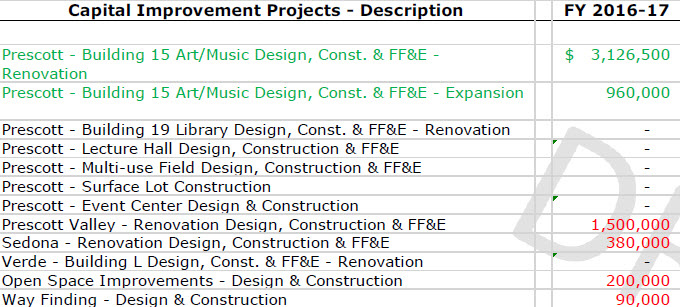

Apparently, the College didn’t need the 2015-16 revenue (but said nothing about this during 2015-16) because: (a) It failed to quickly fill employee vacancies during that period, (b) Contingency revenue was not needed, and (c) It had already spent money in 2014-15 for a number of construction projects that were completed or partially completed in that fiscal year but showed up in the 2015-16 budget.

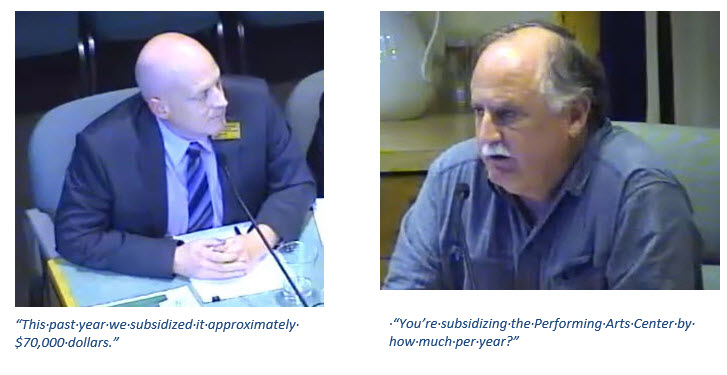

A short three minute edited videotape of the discussion at the Board meeting in January follows below.

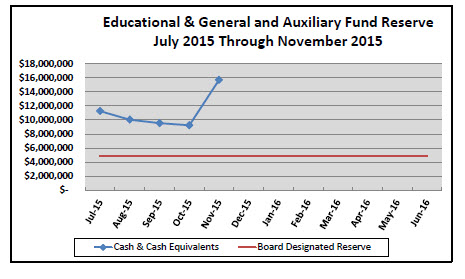

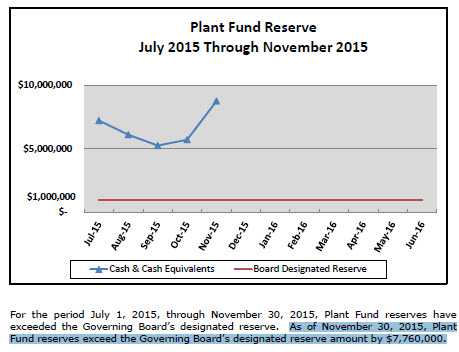

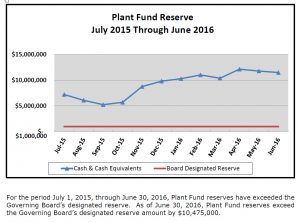

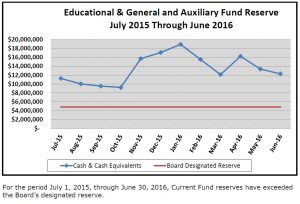

The College Administration will report excess revenue in the General Fund Budget of $2,208,713. It will also report revenue in the Unexpended Plant Fund in excess of $2,770,000. Finally, it will report excess revenue in the Auxiliary budget of $123,621.

The College Administration will report excess revenue in the General Fund Budget of $2,208,713. It will also report revenue in the Unexpended Plant Fund in excess of $2,770,000. Finally, it will report excess revenue in the Auxiliary budget of $123,621.

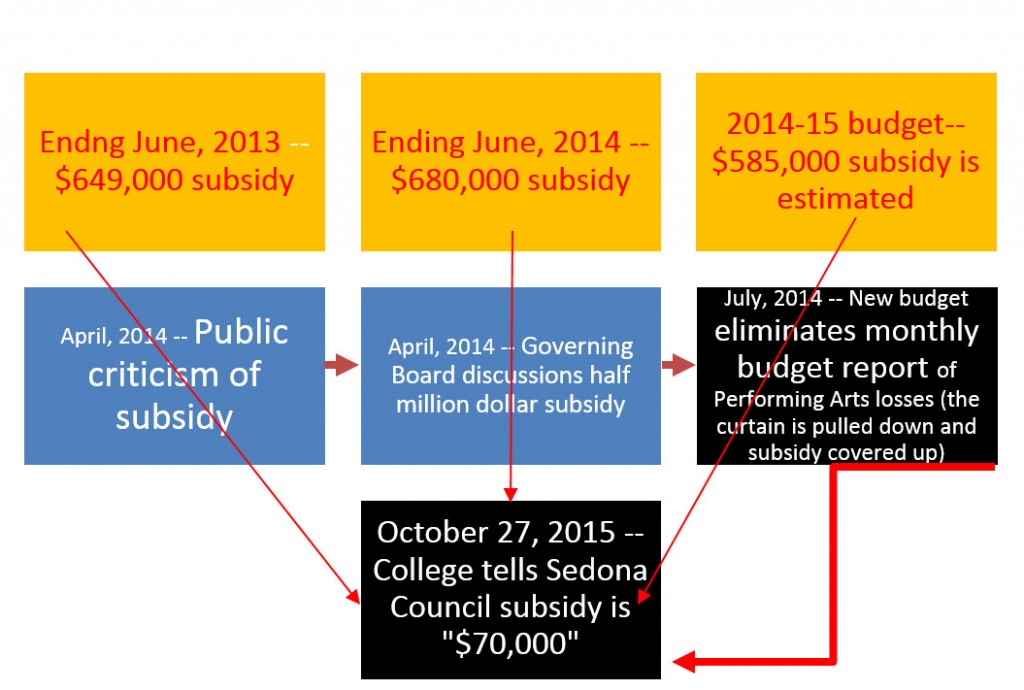

The article made the following points:

The article made the following points: