Special tax adds $903,100 to College Revenue Stream

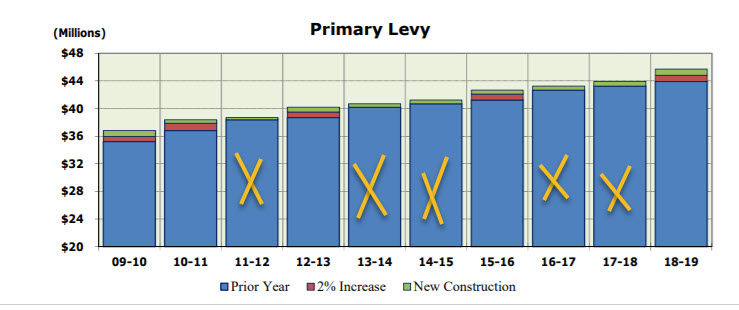

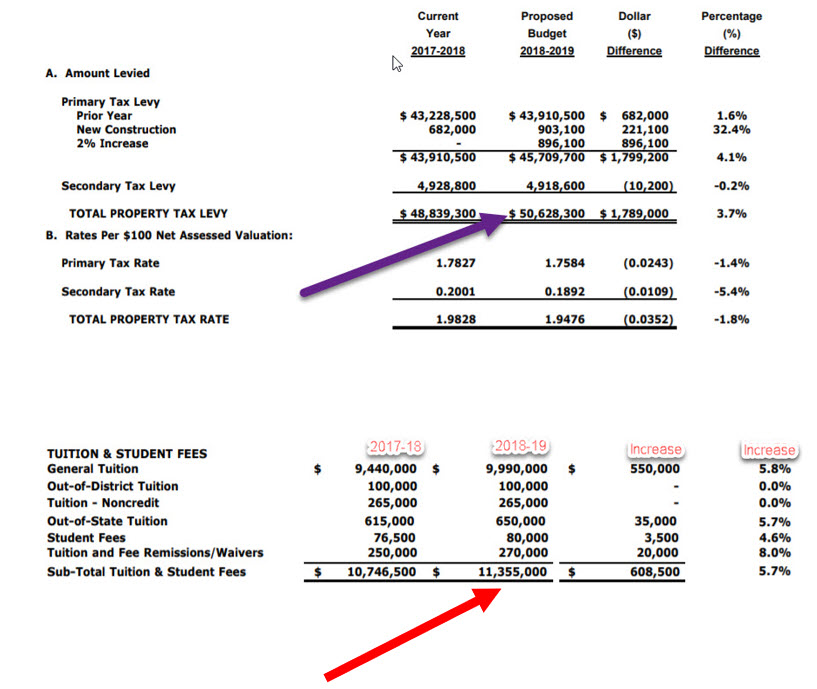

The special construction tax levied on County builders is estimated to generate $903,100 in the 2018-19 academic year for the Community College. According to data issued by the College, this represents an increase of 32.4% over last year.

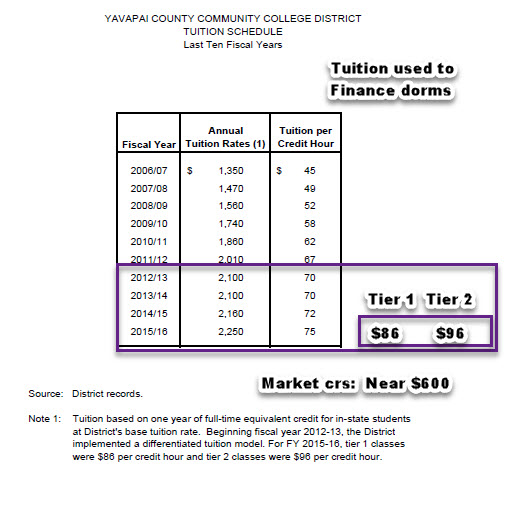

After surveying the Yavapai Community College Governing Board members at the April 2018 meeting, the College Administration has enough votes to increase the County property tax rate by at least 2%. In February 2018 the Board had voted 4-1 (McCasland dissenting) to increased tuition by 5%. The increases will generate at least $1,504,600 in new revenue flowing to the College.

After surveying the Yavapai Community College Governing Board members at the April 2018 meeting, the College Administration has enough votes to increase the County property tax rate by at least 2%. In February 2018 the Board had voted 4-1 (McCasland dissenting) to increased tuition by 5%. The increases will generate at least $1,504,600 in new revenue flowing to the College.

It is of interest that when Yavapai Community College released its press report explaining what took place at the January 16, 2018 Governing Board meeting there was no mention of Wills’ request for a 4% tax rate hike (or 5% tuition increase). But for the Blog and the videotape of the meeting, Yavapai residents would be completely in the dark about her tax rate request. As of this date, there have been no local newspaper accounts of the tax rate request and the Governing Board reaction to it.

It is of interest that when Yavapai Community College released its press report explaining what took place at the January 16, 2018 Governing Board meeting there was no mention of Wills’ request for a 4% tax rate hike (or 5% tuition increase). But for the Blog and the videotape of the meeting, Yavapai residents would be completely in the dark about her tax rate request. As of this date, there have been no local newspaper accounts of the tax rate request and the Governing Board reaction to it. The Wills’ administration, in preliminary talks about the 2018-19 budget at the Governing Board meeting on Tuesday, January 16, sought large increases in revenue flowing to the College. The Administration suggested a four percent increase in the Yavapai County Property Tax rate. It also suggested a five percent student tuition increase for 2018-19.

The Wills’ administration, in preliminary talks about the 2018-19 budget at the Governing Board meeting on Tuesday, January 16, sought large increases in revenue flowing to the College. The Administration suggested a four percent increase in the Yavapai County Property Tax rate. It also suggested a five percent student tuition increase for 2018-19.

With total primary tax-based revenue in 2012 flowing to the College from Yavapai County property taxpayers of $43,701,144.00, this means the Sedona Taxing District alone contributed at least 15 percent of the revenue toward operating the College.

With total primary tax-based revenue in 2012 flowing to the College from Yavapai County property taxpayers of $43,701,144.00, this means the Sedona Taxing District alone contributed at least 15 percent of the revenue toward operating the College.